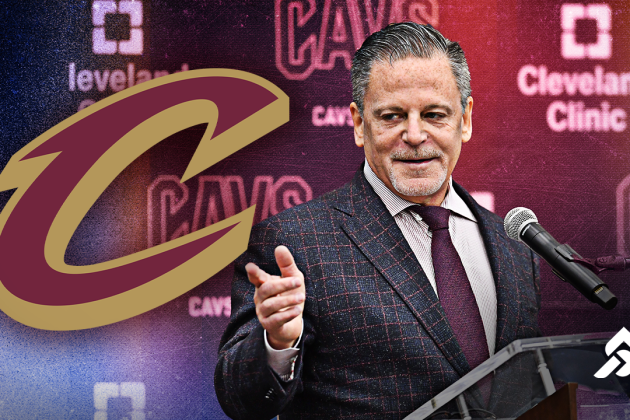

Cleveland Cavaliers owner Dan Gilbert is looking to sell a stake in his NBA franchise, according to a half-dozen sources who asked not to be named because the details are private. He has retained Allen & Company to explore selling up to 15% of the team, according to three of those sources.

The transaction could be in one parcel or to several individuals. Gilbert would retain his majority stake in the team he bought in 2005 for $375 million, which was a record at the time for a standalone NBA franchise. In December, Sportico valued the Cavs at $3.95 billion in its NBA team valuations, which ranks 18th in the league.

The Cavaliers and Allen & Company declined requests to comment.

NBA values have doubled over the past four years—and are up 1,100% over the past 15 years—to an average of $4.6 billion in December. To top that off, in the past three months, the Boston Celtics ($6.1 billion) and Los Angeles Lakers ($10 billion) reached agreements to sell their franchises at 8% and 24% premiums to Sportico’s estimated values.

The Cavaliers are coming off their second-best regular season in franchise history. Their 64-18 record included a franchise-best 15-0 start to the season, and the win tally sits only behind the 66 victories during the 2008-09 campaign. Last month, the Indiana Pacers knocked them out of the playoffs in the Eastern Conference semifinals.

The Cavaliers are led by guard Donovan Mitchell, who was voted First-Team All-NBA this year, and Evan Mobley, who made the second team. Mitchell is under contract for the next two seasons, with a player option for 2027-28, while Mobley starts a five-year, $269 million deal next season, making the Cavs a substantial luxury taxpayer. The team last had to pay the luxury tax during the 2017-18 season, LeBron James’ last with the team before he joined the Lakers.

During Gilbert’s two decades as owner, the Cavaliers have made five NBA Finals—largely on the back of James—with the franchise’s lone title coming in 2016.

Last year, Allen represented immersive media platform Cosm when it raised more than $250 million from investors, including Gilbert. The bank was also retained to lead the WNBA’s expansion process for its 16th team, with a Cleveland bid from Gilbert one of the leading contenders to nab the slot.

Gilbert’s sports assets sit within Rock Entertainment Group and also include the Cleveland Monsters in the AHL and Cleveland Charge in the NBA G League. REG also operates Rocket Arena, Cleveland Clinic Courts and Rock Entertainment Sports Network, a joint venture with Gray Media. In November, the company announced its plans to bid on the WNBA expansion franchise.

Gilbert made his first fortune in the mortgage business with Quicken Loans, which is now Rocket Mortgage. He has a net worth of $32.1 billion, according to Bloomberg.

Sign up for Sportico’s Newsletter. For the latest news, follow us on Facebook, Twitter, and Instagram.

Cleveland Cavaliers owner Dan Gilbert is looking to sell a stake in his NBA franchise, according to a half-dozen sources who asked not to be named because the details are private. He has retained Allen & Company to explore selling up to 15% of the team, according to three of those sources.

The transaction could be in one parcel or to several individuals. Gilbert would retain his majority stake in the team he bought in 2005 for $375 million, which was a record at the time for a standalone NBA franchise. In December, Sportico valued the Cavs at $3.95 billion in its NBA team valuations, which ranks 18th in the league.

The Cavaliers and Allen & Company declined requests to comment.

NBA values have doubled over the past four years—and are up 1,100% over the past 15 years—to an average of $4.6 billion in December. To top that off, in the past three months, the Boston Celtics ($6.1 billion) and Los Angeles Lakers ($10 billion) reached agreements to sell their franchises at 8% and 24% premiums to Sportico’s estimated values.

The Cavaliers are coming off their second-best regular season in franchise history. Their 64-18 record included a franchise-best 15-0 start to the season, and the win tally sits only behind the 66 victories during the 2008-09 campaign. Last month, the Indiana Pacers knocked them out of the playoffs in the Eastern Conference semifinals.

The Cavaliers are led by guard Donovan Mitchell, who was voted First-Team All-NBA this year, and Evan Mobley, who made the second team. Mitchell is under contract for the next two seasons, with a player option for 2027-28, while Mobley starts a five-year, $269 million deal next season, making the Cavs a substantial luxury taxpayer. The team last had to pay the luxury tax during the 2017-18 season, LeBron James’ last with the team before he joined the Lakers.

During Gilbert’s two decades as owner, the Cavaliers have made five NBA Finals—largely on the back of James—with the franchise’s lone title coming in 2016.

Last year, Allen represented immersive media platform Cosm when it raised more than $250 million from investors, including Gilbert. The bank was also retained to lead the WNBA’s expansion process for its 16th team, with a Cleveland bid from Gilbert one of the leading contenders to nab the slot.

Gilbert’s sports assets sit within Rock Entertainment Group and also include the Cleveland Monsters in the AHL and Cleveland Charge in the NBA G League. REG also operates Rocket Arena, Cleveland Clinic Courts and Rock Entertainment Sports Network, a joint venture with Gray Media. In November, the company announced its plans to bid on the WNBA expansion franchise.

Gilbert made his first fortune in the mortgage business with Quicken Loans, which is now Rocket Mortgage. He has a net worth of $32.1 billion, according to Bloomberg.